Taxes

Tax Rates 2024-2025

FY24 | FY25 | Increase from FY24-FY25 | |

| Village Tax Rate | 0.2122 | 0.2236 | 0.0114 |

| Cost per $100,000 Resident | $212.20 | $223.60 | $11.40 |

FY24 | FY25 | Increase from FY24-FY25 | |

| Town Tax Rate | 0.6022 | 0.6301 | 0.0279 |

| Town Police Rate* | 0.0702 | 0.071 | 0.0008 |

| Homestead Education Tax | 2.0198 | 2.6303 | 0.6105 |

| Non-Residential Education Tax | 1.8456 | 2.1854 | 0.3398 |

| Total Resident Tax Rate | 2.6922 | 3.3314 | 0.6392 |

| Total Non-Residential Tax Rate | 2.518 | 2.8865 | 0.3685 |

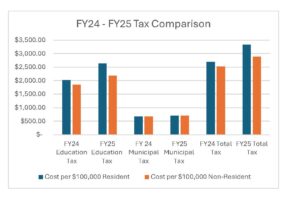

FY24 Education Tax | FY 24 Municipal Tax | FY24 Total Tax | FY25 Education Tax | FY25 Municipal Tax | FY25 Total Tax | Increase from FY24-FY25 | |

Cost per $100,000 Resident | $2,019.80 | $672.41 | $2,692.21 | $2,630.30 | $701.06 | $3,331.36 | $639.15 |

Cost per $100,000 Non-Resident | $1,845.60 | $672.41 | $2,518.01 | $2,185.40 | $701.06 | $2,886.46 | $368.45 |

| *Village Residents did not pay this tax portion |

Letter from the Municipal Manager Eric Duffy regarding taxes:

TownTaxRateFY2025

State Education Tax Forms

Homestead Declaration & Property Tax Adjustment Claim: HS-122 Form

Household Income HI-144 Form

General Tax Information

(802) 457-3456 Opt 1; [email protected]

TAX PAYMENTS:

The Town/Village of Woodstock runs on a fiscal year from July 1st through June 30th. Property tax bills are payable in two installments. The first installment is due the first Friday in November. The second installment is due the first Friday in May. Checks should be made payable to the Town of Woodstock, and include the parcel ID on the memo line. They may be mailed to Town of Woodstock, PO Box 488, Woodstock, VT, 05091.

Late payments in November accrue interest at 1% for the first three months and 1 1/2% per month thereafter. Delinquent payments after the May due date are assessed a 8% penalty and accrue interest at 1% for the first 3 months and 1 1/2% thereafter.

Transfer of Property:

If all or part of the property is sold, it is the Seller’s responsibility to forward the bill to the new owner, and it is the new owner’s responsibility to take note as to when the tax installments are due and payable. Your attorney should review this with you at closing.

By law, only one owner will receive a tax bill. If you purchased property in Woodstock after April 1st of any given year, you will not receive a tax bill in your name until after the following April 1st. Failure to receive a bill does not relieve the new property owner of the responsibility for paying for taxes when they become due and payable, nor does it relieve the addition of penalties and interest as required by law. The office must be notified in writing of any address changes. If you did not receive a copy of the tax bill at the time of the property closing, please stop by the Municipal Manager’s office, and a copy will be made for you.

Tax FAQ

When are my taxes due?

Property tax bills for the Village and Town are billed in two installments and are due:

THE FIRST FRIDAY IN NOVEMBER & THE FIRST FRIDAY IN MAY

Taxes are due in the Tax Collector’s office in Town Hall by the close of business (4:30 p.m.) on the due date. Payments mailed must also be received by the due date. We do not honor postmark as on time payments.

Payments may be made in cash, check or money order payable to the Town of Woodstock. Credit cards can be used on our website townofwoodstock.org by clicking on online payment option. We are always available to assist you in person. The Tax Collector’s office is located on second floor, first door on the right in Town Hall.

Payments may be brought in person to:

Town of Woodstock

31 The Green

Woodstock, VT 05091

2nd Floor-Municipal Manager’s Office

Hours-8AM-12-Noon, 1PM-4:30PM, M-F

Payments may be mailed to:

Town of Woodstock

PO Box 488

Woodstock, VT 05091-0488

When are Property Taxes late/delinquent?

Taxes are due in the Tax Collector’s office by the close of business (4:30 p.m.) on the due date. Payments mailed must also be received by the due date. We do not honor postmark as on time payments.

Taxes not paid by the DUE DATE will be charged 1% interest for the first three (3) months and 1.5% thereafter.

If the second installment DUE DATE is not paid in full, they are delinquent. An 8% penalty will be charged on any principal, interest for the first (3) months is charged at 1% interest and 1.5% interest thereafter.

What if I didn’t get a tax bill?

Bills are sent to the address of the last known owner by state law. The Lister’s Office updates its records according to transfers recorded and received from the Town Clerk. Your attorney or closing company should have checked the status of taxes due. If you have questions about this, refer to your closing statement and/or give us a call. The change of address will be processed after receiving a written request by the land owner. Written requests may also be faxed or emailed.

What if my taxes are escrowed by my mortgagee?

Your bank or mortgage company should instruct you as to whether or not you need to send them a copy of your tax bill. It is always best to verify that they have paid your bill each time.

Where to make payments:

Tax payments may be made at the Municipal Manager’s Office, located at 31 The Green, second floor during regular office hours, or may be mailed to Town of Woodstock, PO Box 488, Woodstock, VT 05091

Questions about tax bills and tax payments or delinquency issues may be directed to Jason Bishop at (802) 457-3456 Opt 1. The Homestead Declaration (HS122) – The Homestead Declaration is the form which needs to be submitted (ANNUALLY) to declare residency for the State of Vermont.

SEWER FEES:

Sewer charges are billed annually and are due in April. Payments received late are accessed a penalty of 8% plus interest of 1% per month for three months and then 1 1/2% per month thereafter. Neither the Treasurer nor the Tax Collector have the authority to waive or abate the interest and penalty charges.

DELINQUENT TAXES:

Tax payments must be received on or before the November due date or will accrue interest of 1% per month for three months and then 1 1/2% per month thereafter. Delinquent payment after the May due date are assessed a 8% penalty and will accrue interest at 1% the first 3 months and 1 1/2% thereafter (per Title 32 of the Vermont Statutes Annotated Chapter 133). Neither the Treasurer nor the Tax Collector have authority to waive or abate the interest and penalty charges.

The Delinquent Tax Collector sends out bills and every effort is made to accommodate people who try to satisfy their obligation and also provides an accounting of these records to the auditors for inclusion in the Town Report. According to State statute, within twenty days after the final due date (or the date at which the final installment is due) the treasurer must issue to the delinquent tax collector a warrant against the delinquent taxpayers in the amount of taxes remaining unpaid. This warrant remains in effect until all taxes on it are paid or otherwise discharged. The treasurer delivers the warrant to the delinquent tax collector who then must proceed to collect the taxes.

Accounts in arrears may be sent to the Town Attorney for tax sale. The collection of delinquent taxes has a direct bearing on the Town/Village’s financial condition. In almost all tax sale cases, full payment is made before the tax sale actually becomes final.